All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash value of an IUL are normally tax-free up to the amount of premiums paid. Any type of withdrawals above this amount may go through taxes depending on plan structure. Traditional 401(k) contributions are made with pre-tax bucks, minimizing gross income in the year of the contribution. Roth 401(k) contributions (a strategy feature offered in a lot of 401(k) plans) are made with after-tax payments and then can be accessed (incomes and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the individual mores than 59. Properties withdrawn from a typical or Roth 401(k) prior to age 59 might incur a 10% charge. Not specifically The insurance claims that IULs can be your own financial institution are an oversimplification and can be misguiding for many reasons.

However, you may be subject to upgrading connected wellness inquiries that can influence your recurring costs. With a 401(k), the cash is always yours, consisting of vested company matching despite whether you give up contributing. Risk and Assurances: Firstly, IUL plans, and the cash money worth, are not FDIC guaranteed like conventional financial institution accounts.

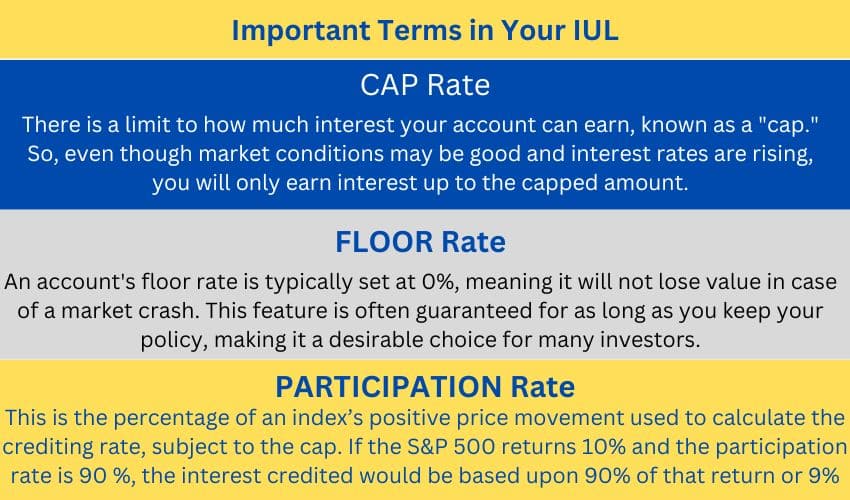

While there is normally a flooring to avoid losses, the growth possibility is covered (implying you may not totally gain from market increases). Most professionals will certainly concur that these are not equivalent items. If you desire survivor benefit for your survivor and are concerned your retirement cost savings will not suffice, after that you may intend to think about an IUL or other life insurance policy product.

Certain, the IUL can give accessibility to a money account, however once again this is not the primary objective of the item. Whether you desire or require an IUL is a very specific inquiry and depends upon your main monetary objective and goals. Below we will certainly try to cover advantages and limitations for an IUL and a 401(k), so you can further define these items and make an extra informed choice regarding the ideal way to take care of retirement and taking treatment of your liked ones after fatality.

Universal Index Life Policy

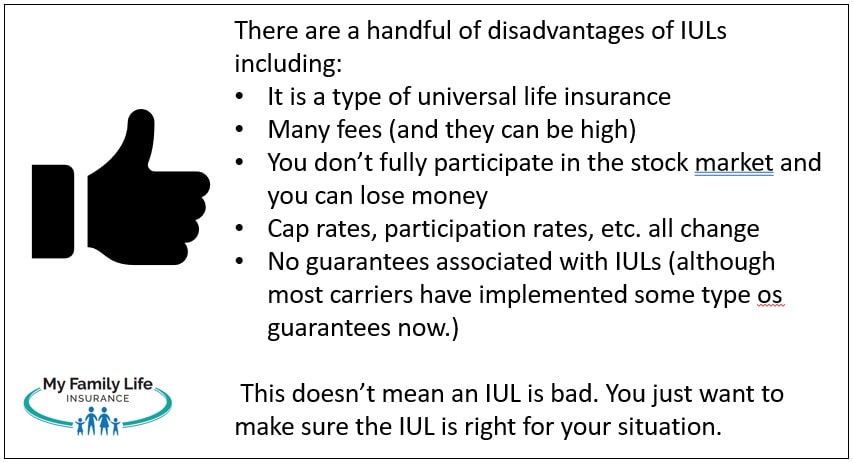

Car Loan Prices: Fundings versus the policy accrue interest and, if not settled, reduce the survivor benefit that is paid to the recipient. Market Engagement Restrictions: For the majority of plans, investment development is linked to a stock exchange index, but gains are generally covered, limiting upside possible - wrl iul. Sales Practices: These policies are often offered by insurance coverage agents that may emphasize advantages without fully describing prices and risks

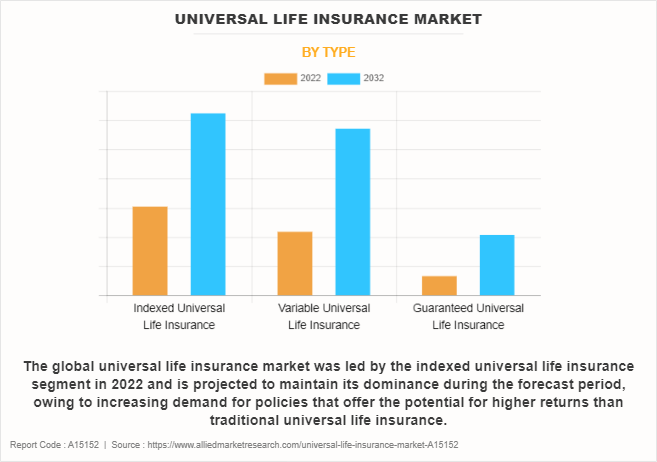

While some social media pundits suggest an IUL is a replacement product for a 401(k), it is not. These are different products with different goals, features, and expenses. Indexed Universal Life (IUL) is a type of irreversible life insurance coverage policy that also provides a cash value part. The cash money worth can be made use of for multiple purposes including retirement savings, supplementary income, and other economic demands.

Latest Posts

Freedom Global Iul

Indexed Universal Life Insurance

Max Funded Iul: Retire Richer, Faster With Your Index ...